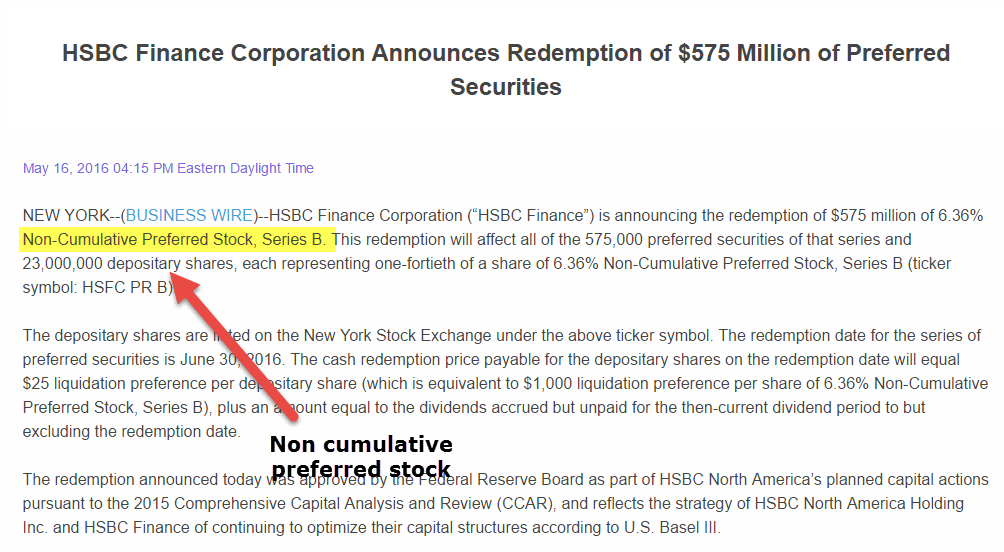

cumulative preferred stockholders have the right to receive

Topic subject area number of pages spacing urgency academic level number of sources style and preferred language style. A type of preferred stock with a higher claim on assets and dividends than other issues of preferred stock.

Non Cumulative Preference Shares Advantages And Disadvantages

Preferred stockholders also have preference on corporate assets if the corporation fails.

/book-with-page-about-preferred-stock--trading-concept--814447584-db8f837c330d4d8e9974c345d342867d.jpg)

. For example a 10 dividend on 80 preferred stock is an 8 dividend. Thus it is sometimes beneficial to detach and sell a warrant as soon as possible so the investor can earn dividends. Have your academic paper written by a.

Read more have a higher priority and claim on dividends than common shares. The staff believes that when consideration received for preferred stocks reflects expectations of future dividend streams as is normally the case with cumulative preferred stocks any discount due to an absence of dividends as with Class A or gradually increasing dividends as with Class B for an initial period represents prepaid unstated dividend cost. Start studying Chp 11.

Our customers have the right to request and get a refund at any stage of their order in case something. In the case of warrants issued with preferred stocks stockholders may need to detach and sell the warrant before they can receive dividend payments. Cumulative preferred stocks allow companies to suspend dividend payments when times are bad but they must pay all of the missed dividend payments when times are good again.

In the event of bankruptcy holders of common stock have the lowest-priority claim on a companys assets and are behind secured creditors such as banks unsecured creditors such as bondholders. Preferred stocks without that advantage are called non-cumulative stocks. Have your academic paper written by a professional.

For example Company XYZ declares 10 cumulative dividends Dividends Dividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the. Whether dividends paid on stock are considered assets depends on which role you play in the investment. Preferred stockholders have the right to receive dividends BEFORE common stockholders.

Prior Preferred Stock. However their claims are discharged before the shares of common stockholders at the time of liquidation. In other words preferred stockholders receive their dividends before the common stockholders receive theirs.

When it comes to dividends and liquidation the owners of preferred stock have preferential treatment over the owners of common stock. O However preferred shareholders are NOT guaranteed a dividend each year. Learn vocabulary terms and more with flashcards games and other study tools.

If a firm did. They must do that before they can make any dividend payments to common stockholders. The issuing company or the investor.

Preferred stock dividends may be stated as a fixed amount such as 5 or as a percentage of the stated price of the preferred stock. Preferred stock holders can have a broad range of voting rights ranging from none to having control over the eventual disposition of the entity. As an investor in the stock market any income you.

Cumulative Preferred Stock Definition Business Example Advantages

Solved Colliers Inc Has 100 000 Shares Of Cumulative Chegg Com

Cumulative Preferred Stock Definition Accounting Dictionary Preferred Stock Accounting Earnings

Let S View Complete Details About Preference Shares Preferences How To Find Out Let It Be

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

3 Levels Of Project Quality Because Quality Costs Money Infographic Projectmanagement Infographic Social Media Software Social Media Schedule

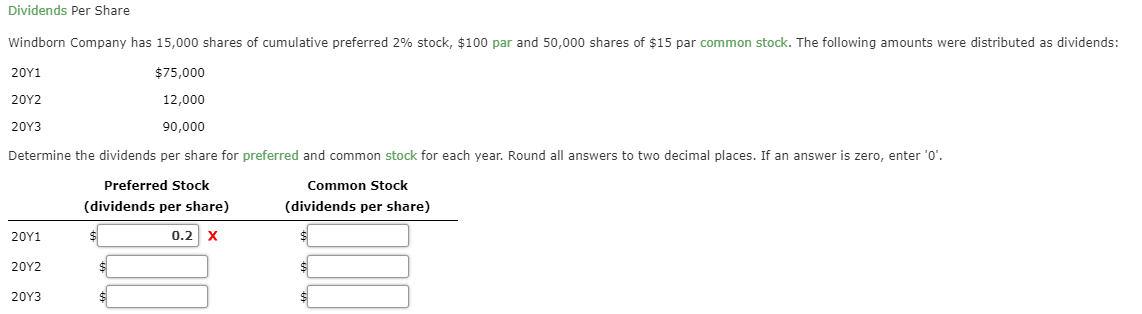

Solved Dividends Per Share Windborn Company Has 15 000 Chegg Com

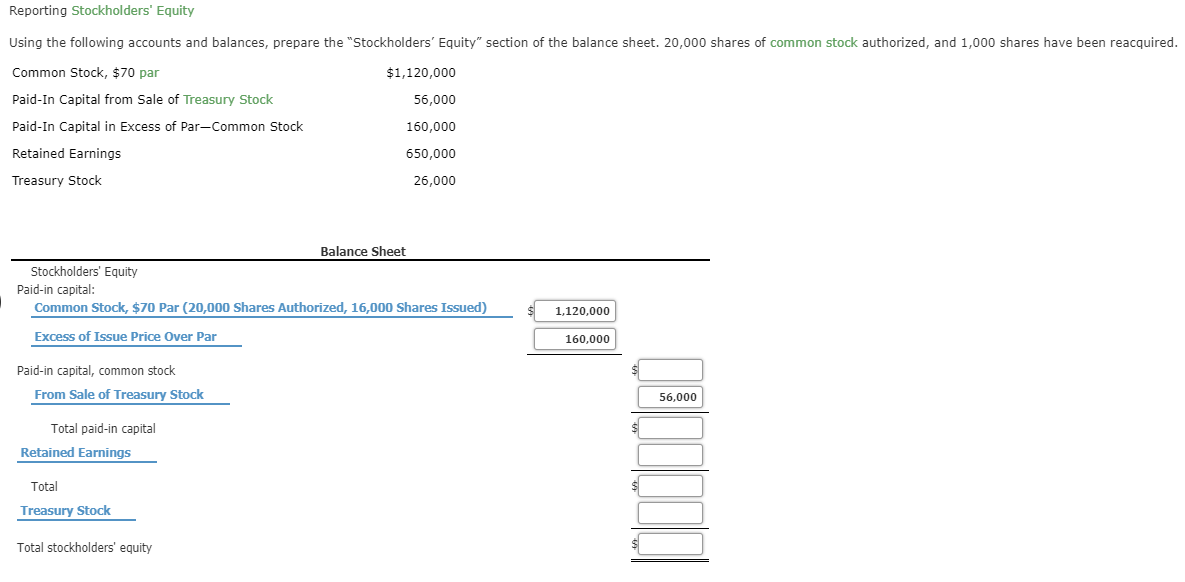

Preferred Shares Meaning Examples Top 6 Types

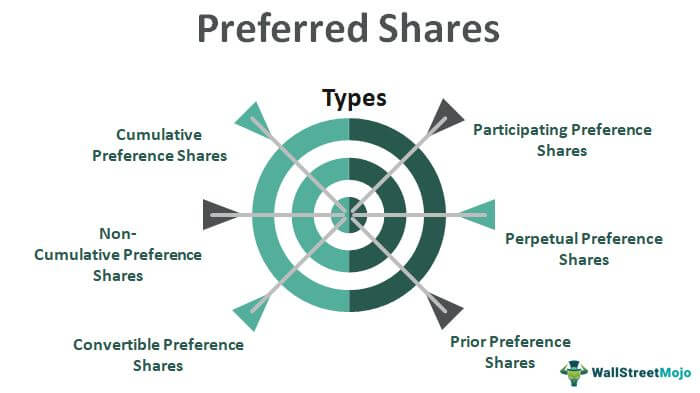

Solved 1 Prepare The Journal Entry To Record Tamas Chegg Com

/book-with-page-about-preferred-stock--trading-concept--814447584-db8f837c330d4d8e9974c345d342867d.jpg)

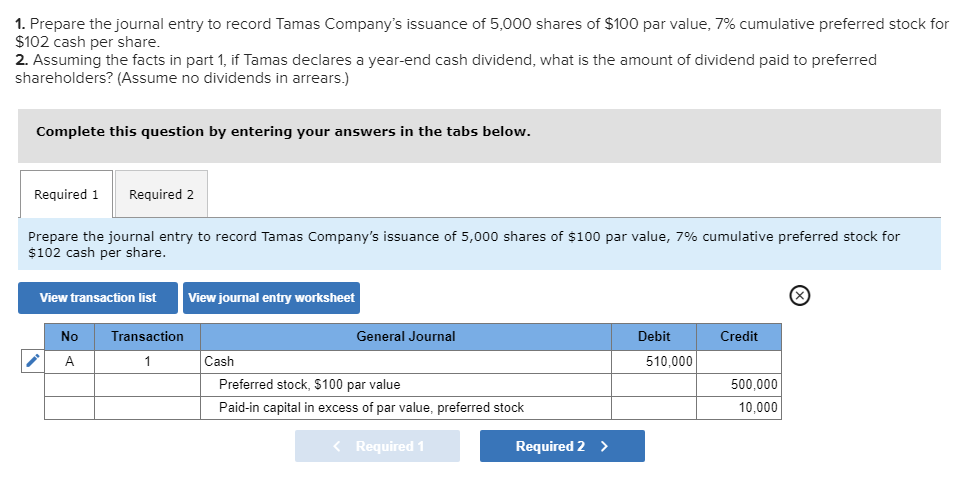

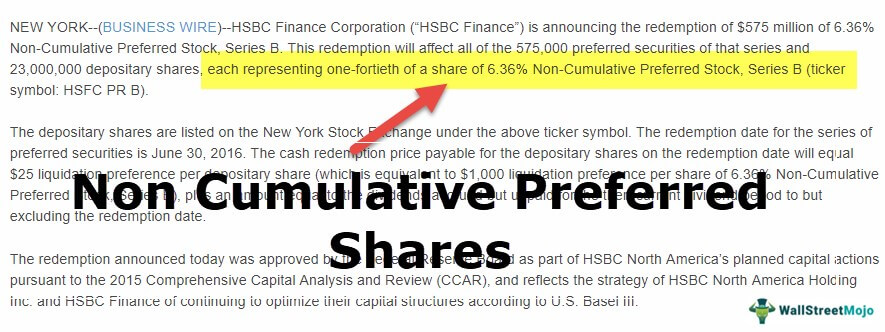

Noncumulative Definition And Examples

Preferred Shares Meaning Examples Top 6 Types

Preferred Shares Meaning Examples Top 6 Types

Solved Dividends Per Share Windborn Company Has 15 000 Chegg Com

Participating Vs Non Participating Preferred Stock Alcor Fund

Preference Shares And Its Different Types Sag Rta Preferences Exams Funny Financial Management

Non Cumulative Preference Shares Stock Top Examples Advantages

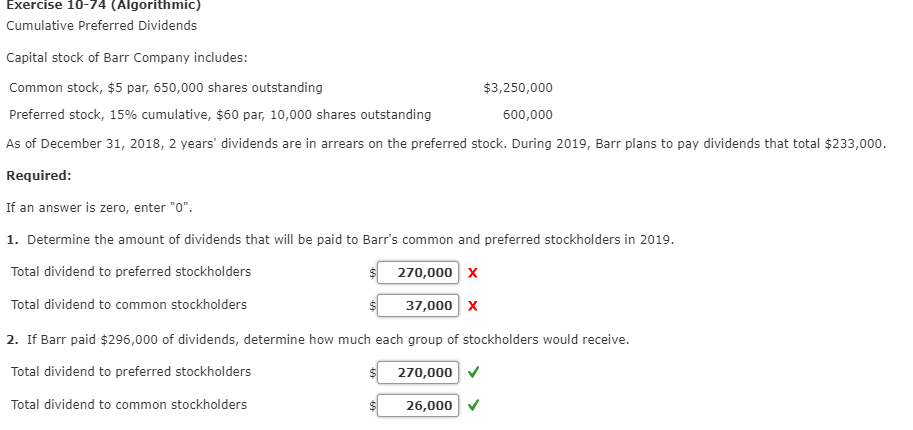

Solved Exercise 10 74 Algorithmic Cumulative Preferred Chegg Com

Cumulative Preferred Stock Definition

Difference Between Cumulative And Non Cumulative Preferred Stocks With Table Ask Any Difference